Areas of Practice

Bankruptcy Law in Downriver Michigan

Tough decisions should not burden us for life. You owe it to yourself and your family to live a fulfilling lifestyle, and this begins with taking control of your finances. Whether it’s through bankruptcy or another path, there is a legal, honest way to regain financial stability. If you have lost or are at risk of losing this stability, call us for a free consultation to discuss your rights and the path to financial freedom.

Demystifying Bankruptcies

Many misconceptions exist in regard to bankruptcy law, such as the erroneous idea that you would have to give up more than you really do. Even after you file for bankruptcy, many legal safeguards are in place that can help protect your physical, emotional, and financial well-being. Watch our videos to learn more about troubles you may be facing, and contact us for a free consultation. The path to the right solution for you may be just a phone call away.

Too Much Debt?

Tough decisions should not burden us for life. You owe it to yourself and your family to live a fulfilling lifestyle, and this begins with taking control of your finances. Whether it’s through bankruptcy, debt consolidation, or another path, there is a legal, honest way to regain financial stability.

If you’re worried about the repercussion from filing for bankruptcy, that’s a valid concern. However, some of your concerns may be simply myths without any substance.

Myth #1:

“I won’t be able to own anything after I file.”

WRONG.

Myth #2:

“I’m current on my car payments and they’ll take my car!”

WRONG.

Myth #3:

“I won’t be able to own property again or for a very long time.”

WRONG.

Myth #4:

“I’ll lose my tax refunds.”

WRONG.

The Downriver Bankruptcy Filing Process

- Free legal consultation at The Law Offices of Bryan Yaldou, PLLC. You’ll provide your taxes, paystubs, and bills you’d like to include. We see what you qualify for.

- A $200 deposit is given and then we stop paying on all debt included in the case. We advise you to stop using credit and to let creditors known that you’ve been retained and to stop calling.

- Take a credit counseling class online, provide us with remaining documents and fee.

- Prepare and sign documents to be filed.

- Attend a 5-minute Zoom hearing with Bryan Yaldou 4-6 weeks later when case is filed.

- Wait 60 days for Order of Discharge which is your proof that your debt has been wiped clean.

- Watch as your credit begins rebuilding immediately after the case is over.

If you have lost or are at risk of losing this stability, call us for a free consultation to discuss your rights and the path to financial freedom.

When should I file for bankruptcy?

Filing a case depends on your situation. Discuss this with your attorney to determine the best time for you. Timing does matter. It can make a big difference in which debts you can discharge and which assets you can protect.

Tough decisions should not burden us for life. You owe it to yourself and your family to live a fulfilling lifestyle, and this begins with taking control of your finances. If you have lost or are at risk of losing this stability, call us for a free consultation to discuss your rights.

Credit Card/Medical Debt

Foreclosure Prevention

Q: Can I keep my house if I file for bankruptcy?

A: In most circumstances, the answer is yes! Discuss your circumstances with your attorney. An attorney can determine if there is any particular advantage to the type of bankruptcy you are eligible to file and how it could affect your property.

Stop Garnishments

If a garnishment has already been taken from your check, filing for bankruptcy can stop future garnishments. Additionally, if your funds have already been garnished within 90 days of filing for bankruptcy and the garnishment from one creditor was more than $600, we may be able to recover those funds and return them to you.

Garnishments can have a life altering effect on your livelihood. Creditors may garnish up to 25% of your paycheck until your debt is paid off. Creditors may also take the entire balance in your bank account or your state tax refund every year to satisfy a debt. But you have options. You do not need to be the victim. Call us for a free consultation, and let us help you regain your financial freedom.

Repossession/Car Loan

Q: Can I stop a repossession or get a vehicle returned if I file a bankruptcy?

A: Yes, timing is everything. If the vehicle has not been sold at auction, in most cases it can be quickly returned. Don’t wait!

An auto repossession occurs when the lienholder attempts to take back a vehicle after payments have been missed. The loss of a vehicle can have devastating effects on your life, often impacting your employment. Fortunately, there are options for recovering a repossessed vehicle and restructuring the associated debt to make repayment terms more affordable.

If your vehicle has already been repossessed, you must act before your car is sold at auction. Contact us at (734) 692-9200 to set up a free consultation to learn how to:

- Stop a repossession before it occurs.

- Force a creditor to return a vehicle after repossession but before the auction sale.

- Modify the repayment terms of your auto loan, including the monthly payment and secured loan balance.

- Safely return an unaffordable vehicle to a lender and eliminate the associated deficiency debt.

Making a Car Loan More Affordable

If you are experiencing difficulty making your vehicle payments, there may be options. One option is to file a Chapter 13 bankruptcy. By doing so, you may be able to keep your car and reduce the monthly price to make the loan more affordable.

IRS & State Tax Debt

If you owe the IRS or State of Michigan, you have options for resolving tax debt and avoiding a tax levy. Your ability to eliminate income tax debt rests on a variety of factors. During a free consultation, we can discuss whether a Chapter 7 or a Chapter 13 is the best course of action to protect your check.

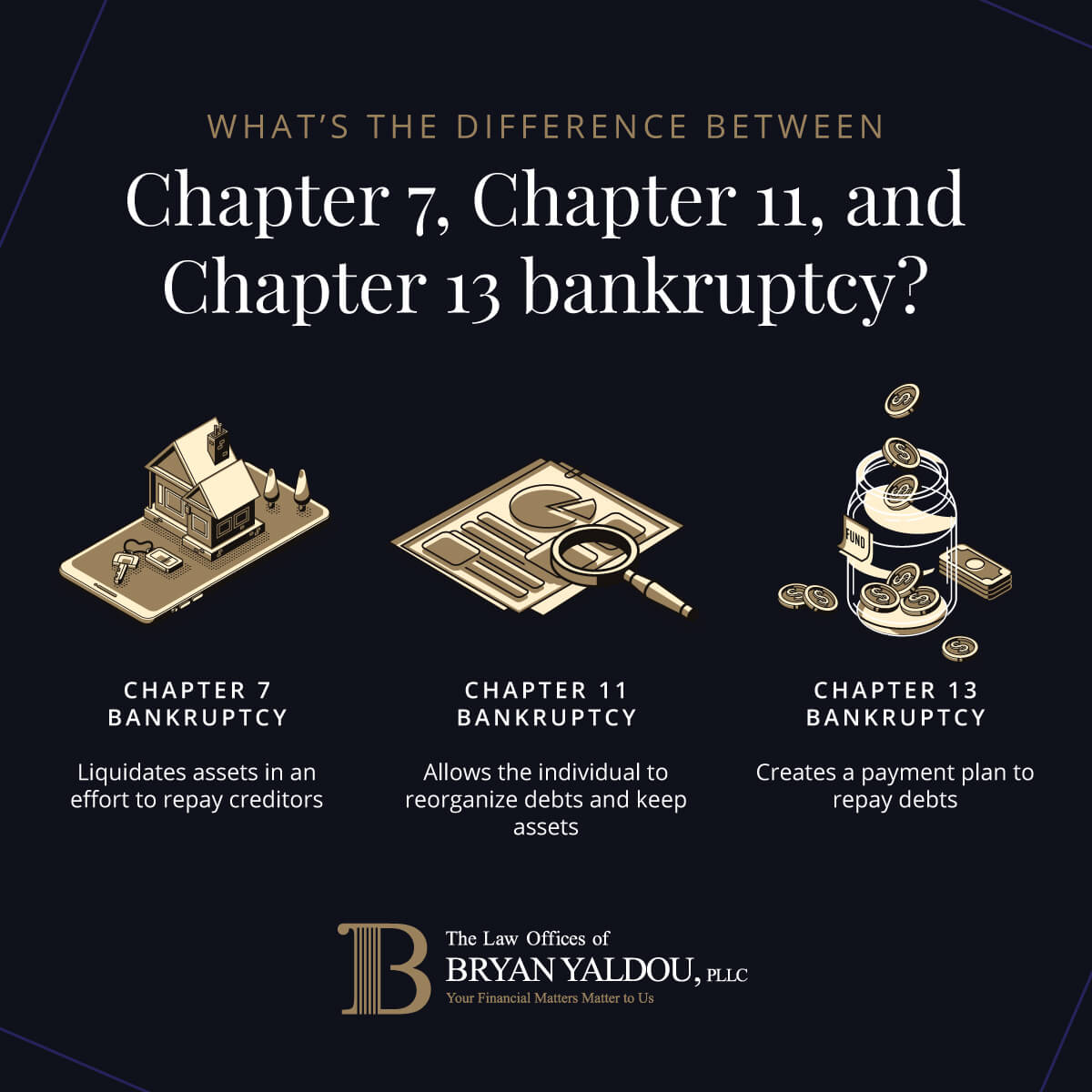

Chapter 7

Generally, income tax debt that was incurred over three years ago can be discharged by a Chapter 7, meaning you will not be required to pay the debt. However, there are exceptions to discharge, including the date your tax return was filed. We will work with you to determine whether Chapter 7 is the right course of action to resolve your tax issues.

Chapter 13

Chapter 13 allows an individual to reorganize income tax debt regardless of when it was incurred. A Chapter 13 may be a good option for you if the tax is less than three years old, considered non-dischargeable, or is secured by a tax lien. Treating income tax debt will allow for repayment over a three- to five-year period. While your Chapter 13 case is active you are protected from collection efforts by the IRS and state taxing authority.

Eliminate Second Mortgage

If the value of your home is less than what you owe on your first mortgage, it may be possible to eliminate your second mortgage or home equity loan. Under Chapter 13, an individual may “strip” a lien from collateral, including a home, if there is no equity supporting the lien (first mortgage balance is greater than the home value). By stripping the lien, the debt is treated as an unsecured debt. For most people, Chapter 13 allows for the repayment of unsecured debt at pennies on the dollar.

After the successful completion of the Chapter 13 plan, documents are filed with the Register of Deeds, which removes the stripped second mortgage or home equity loan lien from your home. Any unpaid portion of the stripped lien is eliminated (“discharged”) and may not be collected upon by a creditor.

Utility Shutoff

If you are facing utility shutoffs, it is time to consider filing for bankruptcy. Utilities are necessary for keeping your family safe and comfortable. Even if you have already lost services, we can help. Call us today to discuss how best to protect you and your family from utility shutoff.

Debt Settlement

- Ensuring the debt settlement agreement is enforceable.

- Obtaining an agreement that releases you from the unpaid balance.

- Negotiating how the settlement agreement is reported on your credit report to minimize negative credit implications.

There are significant differences between debt settlement and bankruptcy. Call us today to learn more.

Q: What about credit counseling and debt negotiation and settlement?

A: Although many people try to negotiate with their creditors, a voluntary agreement with your creditors does not force them to stop any collection activities against you. Also, your debt can and often does accrue interest and penalties while in that process. Bankruptcy stops attempts to collect debts and in most cases freezes the amount you owe as of the date of the filing of your case.

We're Here To Help

Schedule a free consultation to learn more about your options when it comes to bankruptcy

Our Approach & What To Expect

Bankruptcy law is complex, and each situation is different. Our clients often ask us basic questions about the steps involved in a bankruptcy case. While no case is the same, answers to common questions are below. Contact us for specifics.

How long will it take before I can get credit to buy a car or house?

Can I file alone if I'm married, or should both spouses file bankruptcy?

Are my retirement accounts such as my pension, IRA, or 401k/403b safe?

I've filed before. May I file bankruptcy again?

Can I be prevented from getting a job if I file bankruptcy?

What should I not do before filing a bankruptcy?

- Charging or incurring significant amounts of debt before starting a case

- Paying back friends or family money you borrowed from them

- Transferring money or property (such as houses, land, or vehicles) to friends and family for less than fair market value

Some of these mistakes can cause you to lose the property, your discharge, or worse.

When should I file for bankruptcy?

Can I keep my house if I file for bankruptcy?

Can I be prevented from getting a job if I file bankruptcy?

Are credit counseling and debt negotiation and settlement viable options?

Stop allowing challenges to take over your life. Start overcoming them today.

Get Your

Free Consultation

Sign Up

To Receive The Latest Updates From Bryan Yaldou

Counselor Journal

Explore our law blog posts to learn more about Chapter 7 and Chapter 13 bankruptcy options, overtime and unpaid wage laws, protecting your paycheck, personal injury claims, and general information that can help you make informed decisions.

Can You Include Medical Bills When Filing Bankruptcy in Michigan?

Between the health crisis due to the coronavirus pandemic and the number...

read moreTax Returns and Bankruptcy: Basic Facts that Can Help You Prepare

Many Michiganders who have lost their jobs due to the coronavirus...

read moreYour Legal Rights when Including Utility Bills in a Bankruptcy Filing

“Will my lights be shut off if I include utility bills in my bankruptcy?...

read more

Brownstown, MI 48134

- Follow

- Follow

- Follow

- Follow

Counselor Journal